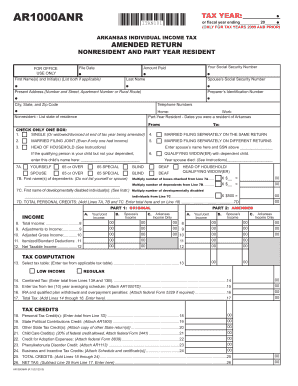

AR DFA AR1000ANR 2010-2025 free printable template

Show details

Your Signature Occupation Date Spouse s Signature Paid Preparer s Signature ID Number/SSN Firm Name Or yours if self employed Telephone Address May the Arkansas Revenue Agency discuss this return with the preparer shown to the left Yes No Mail to Amended Tax Group P. O. Box 3628 Little Rock AR 72203 EXPLANATION OF CHANGES TO INCOME DEDUCTIONS AND CREDITS REQUIRED Attach supporting forms and schedules for items changed and give explanations for each change. If you do not attach the required...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ar1000anr ar form

Edit your you ar1000anr arkansas form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ar1000anr ar income return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit arkansas ar1000anr individual income fill online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ar ar1000anr tax return pdf form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AR DFA AR1000ANR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ar ar1000anr amended tax return form

How to fill out AR DFA AR1000ANR

01

Obtain AR DFA AR1000ANR form from the Arkansas Department of Finance and Administration website.

02

Read the instructions provided on the form carefully to understand the requirements.

03

Fill out the identification section with your name, address, and other required personal information.

04

Complete the financial information section accurately, including income details and any deductions.

05

Review the completed form for any errors or omissions.

06

Sign and date the form as required.

07

Submit the form electronically or by mail to the address specified in the instructions.

Who needs AR DFA AR1000ANR?

01

Individuals or entities required to file income tax returns in Arkansas.

02

Taxpayers seeking to report income and calculate their tax liability for the year.

03

Those claiming deductions or credits related to their income in Arkansas.

Video instructions and help with filling out and completing ar amended

Instructions and Help about ar1000anr income tax return pdf

Fill

ar1000anr amended individual tax fill form

: Try Risk Free

People Also Ask about ar1000anr ar individual tax nonresident

Do I have to file Arkansas state income tax?

Any PY resident who received any taxable income while an Arkansas resident must file a return, regardless of filing status or gross income amount.

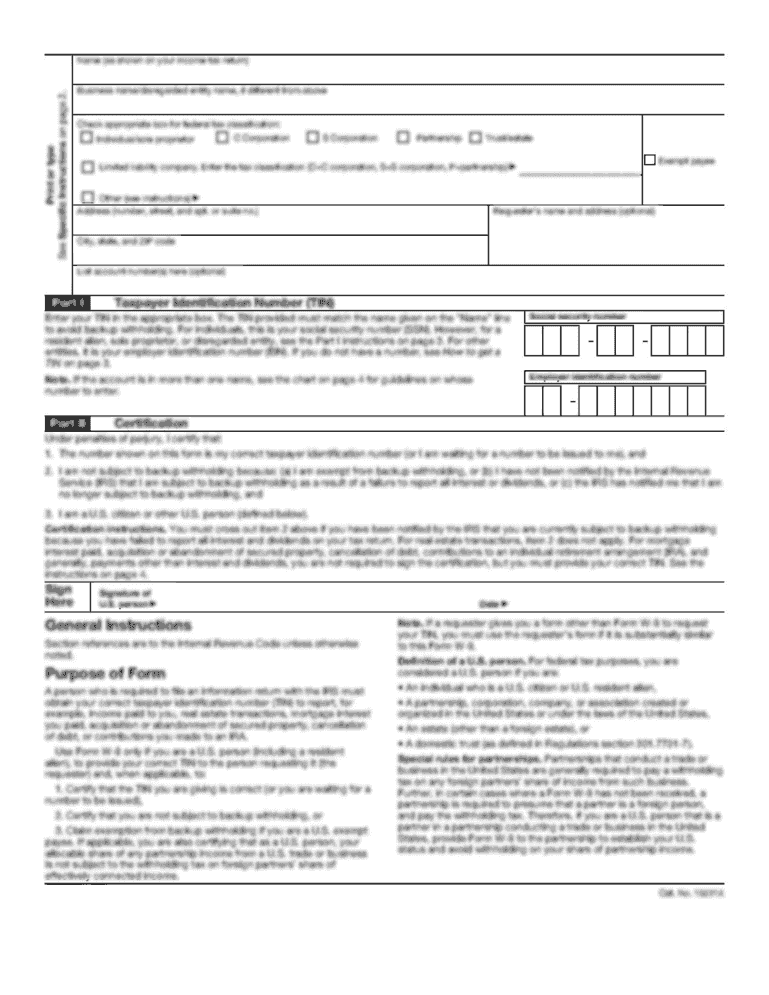

What is AR1000TC?

AR1000TC (R 08/16/2022) ARKANSAS INDIVIDUAL INCOME TAX. TAX CREDITS.

Which people are legally required to file a tax return?

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

Who has to pay Arkansas state income tax?

Just like the federal government, if you earn an income, you must pay income taxes in Arkansas. As a traditional W-2 employee, your Arkansas taxes will be drawn on each payroll automatically. You will see this on your paycheck stub, near or next to the federal taxes.

What is the retirement income exclusion in Arkansas?

If you are retired and receiving retirement benefits from an employer- sponsored pension plan, you are eligible for a $6,000 retirement income exclusion.

Who is required to file Arkansas state tax return?

All non-residents must file a state tax return if they receive any in- come from an Arkansas source. Part-year residents must file a return if they re- ceive any income from any source while a resident of Arkansas.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my you ar1000anr arkansas directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your ar ar1000anr tax return printable and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for the ar1000anr arkansas in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your ar1000anr arkansas tax return and you'll be done in minutes.

How do I complete ar1000anr arkansas individual return resident on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your ar1000anr arkansas tax nonresident. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is AR DFA AR1000ANR?

AR DFA AR1000ANR is a tax form used by businesses in Arkansas to report annual franchise and income taxes.

Who is required to file AR DFA AR1000ANR?

All corporations and certain business entities operating in Arkansas are required to file the AR DFA AR1000ANR.

How to fill out AR DFA AR1000ANR?

To fill out AR DFA AR1000ANR, businesses must provide their financial information, including gross receipts, deductions, and tax calculations, following the instructions provided with the form.

What is the purpose of AR DFA AR1000ANR?

The purpose of AR DFA AR1000ANR is to ensure that businesses report their income and pay the appropriate taxes to the state of Arkansas.

What information must be reported on AR DFA AR1000ANR?

Information that must be reported on AR DFA AR1000ANR includes business identification details, income, deductions, credits, and the total tax owed.

Fill out your AR DFA AR1000ANR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ar1000anr Arkansas Income Tax is not the form you're looking for?Search for another form here.

Keywords relevant to ar1000anr ar tax return resident

Related to ar1000anr ar tax nonresident

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.